Shopify Store Value Calculator

The Millionaire-Maker Strategy

The fastest way to know what your Shopify business is worth and how to scale it to 7-figures. Millionaires don’t guess their numbers — they build them with the right partners!

Built for Shopify store owners by Ignite Viral Media. If your Shopify store value is under $10M a year —we should talk.

Your Shopify Store's Value

Our Ignite Viral Media Strategy

This estimate uses industry-standard multiples, but is not a replacement for a licensed financial advisor. With our guaranteed 3X ROAS offer, average 5.5X returns, and proven growth systems, we can turn your store into a million-dollar asset. Want in? Book your Profit Breakthrough Audit now.

Book Your Profit Breakthrough Audit Call Now>Accurately Estimate Your Online Business Worth

Want to know the value of your Shopify store? The Shopify store value calculator provides a quick and accurate estimate of your business’s worth using your store’s revenue, profit, and traffic data. This guide will show you how to use the tool and understand the valuation results.

Additionally, it is important to consider the anticipated rate of growth in your business earnings. Estimating a percentage growth rate, ranging from 0% to 100%, can help you evaluate potential earnings growth over time.

Introduction to Business Valuation

Business valuation is the process of determining the economic value of a business or company. It is a crucial step for business owners, investors, and potential buyers to understand the business’s value. Business valuations can be used for various purposes, including mergers and acquisitions, securing funding, and estate planning. Regularly assessing a business’s market value can help business owners act decisively during critical moments, such as when potential investors or buyers express interest. There are different valuation methods, including the discounted cash flow method, asset-based approach, and market-based approach. Each method has its strengths and weaknesses, and the choice of method depends on the specific circumstances of the business.

Key Takeaways

- Input key financial data such as annual gross sales, profit percentage after expenses and marketing metrics that directly impact current and future sales for an accurate business valuation.

- Understanding financial metrics, market position, and a business’s market value is essential for interpreting the valuation results and making informed strategic decisions.

- Enhancing Shopify store value involves optimizing marketing strategies, improving customer experience, and diversifying product offerings.

- Brand reputation is a crucial factor influencing business valuation, alongside financial performance, market conditions, and competitive position. A strong brand reputation can significantly affect a business’s perceived value and growth potential.

Understanding Asset Value

Asset value is a crucial component of business valuation, as it represents the total value of a company’s assets, including both tangible and intangible assets. Understanding asset value provides a comprehensive picture of a business’s worth, which is essential for making informed financial decisions.

How to Use the Shopify Store Value Calculator

The Shopify Business Valuation Calculation is straightforward and essential for online business owners. Gather key financial data like revenue and profit margins beforehand for an accurate valuation. The calculator considers various financial metrics, including revenue, profit, and market trends, to provide an estimated value of your store. Additionally, include tangible and intangible company’s assets that the business owns, such as bank accounts, equipment, and intellectual property, as these are critical in determining the overall worth of your business.

One of the best aspects of this tool is its efficiency. Filling out the valuation tool takes only one to two minutes, making it a quick and effective way to calculate business worth. Knowing your Shopify store’s actual value helps you make strategic decisions aligned with your business goals.

Start by inputting three key pieces of information: annual revenue, net profit, and traffic metrics. Each component is vital for the valuation process, which we’ll explore in detail.

Input Annual Revenue

Annual revenue is a fundamental metric for determining your store’s profitability and cash flow. Book value, calculated by subtracting total liabilities from total assets, provides a snapshot of your business’s current value, especially useful for businesses with substantial physical or intangible assets. When entering this information, use your company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) as your annual revenue. This figure provides a clear picture of your business’s financial performance over the past year.

Understanding your business’s market value is crucial for accurate revenue input. It plays a significant role in business decisions and future aspirations, ensuring you are ready to act confidently when opportunities arise.

Business valuation can be influenced by several factors, including total assets, total liabilities, current earnings, projected earnings, market potential, and asset value. Accurately inputting your annual revenue ensures the calculator provides a reliable estimate of what your business is worth, reflecting current profitability and future earnings potential.

Input Net Profit

Net profit represents your company’s profitability and includes earnings before interest, taxes, depreciation, and amortization (EBITDA). When calculating EBITDA, it’s important to consider a manager’s salary to provide a clearer picture of the company’s financial performance for potential buyers. Calculating net profits involves considering operating income, base operating wage, operating expenses, and any excessive compensation, if applicable. Excess compensation can affect the calculation of net profits as it may be reclassified by the IRS, impacting tax deductibility and overall profitability. This figure is crucial as it provides insight into the overall financial health of your business, including net earnings.

Comprehensive historical financial data is crucial for an accurate financial model, and consulting a CPA or using accounting software can be helpful. Understanding net profit allows the business valuation calculator to accurately assess your store’s worth, considering both current value and future profitability.

Input Traffic Metrics

Website traffic data is essential for assessing customer engagement and understanding growth potential. Comparing these metrics with similar businesses can provide a benchmark for valuation. Consider key traffic data types such as unique visitors, page views, and traffic sources. These metrics provide a comprehensive view of how customers interact with your store.

Engagement metrics such as bounce rate and time spent on site can offer deeper insights into customer behavior. Analyzing this data helps store owners identify trends and understand customer preferences, driving growth and contributing to a more accurate valuation of your Shopify store. Additionally, intangible assets like customer engagement play a crucial role in the valuation process, as they reflect the underlying value of your business beyond just physical assets.

Using a Business Valuation Calculator

A business valuation calculator is a tool that helps business owners and entrepreneurs estimate the value of their business. It uses various inputs, such as annual sales, cash flow, and growth projections, to calculate the business’s value. The calculator can provide a quick and easy estimate of the business’s worth, but it is essential to note that it is not a substitute for a comprehensive valuation report. Business owners should consult with a financial expert or valuation professional to get an accurate and detailed assessment of their business’s value.

Understanding Your Shopify Store Valuation Results

Once you’ve input all the necessary data, “The Millionaire-Maker Strategy” formula will provide an estimated value based on inputs and a specific discount rate related to risk level. This tool simplifies complex valuation methods. It makes them easy to use, allowing business owners without extensive financial expertise to access them.

The estimated value is based on certain assumptions. These include projections about future profitability, growth, and various financial metrics. Proper interpretation of these results requires following outlined steps for effective understanding.

Understanding your business’s value is essential when interpreting these valuation results. Interpreting financial metrics and evaluating your market position are crucial for understanding your store’s valuation results.

Interpreting Financial Metrics

Interpreting financial metrics helps understand your store’s value. Annual earnings should reflect income before deductions for interest, taxes, depreciation, and amortization. Net income is established by subtracting all expenses from gross profit.

Net asset value is a crucial metric in financial analysis, as it calculates asset value by subtracting liabilities from total assets, providing a clear financial picture for selling or closing a business.

Cash flow analysis helps to understand current and future potential earnings. A strong financial performance reveals how effectively a business utilizes its assets to generate revenue, impacting its overall valuation.

Evaluating Market Position

Market position plays a crucial role in the valuation of your Shopify store. It reflects your store’s competitive standing within its industry and is influenced by several factors, including financial performance, market conditions, customer engagement, and growth potential.

Evaluating comparable companies can help in understanding your market position, as it relies on the premise that businesses within the same industry tend to have similar valuation metrics. Consistent revenue and profit margins demonstrate financial health and stability, contributing to a strong market position. A loyal customer base and high engagement rates enhance market value by indicating strong brand loyalty and customer satisfaction.

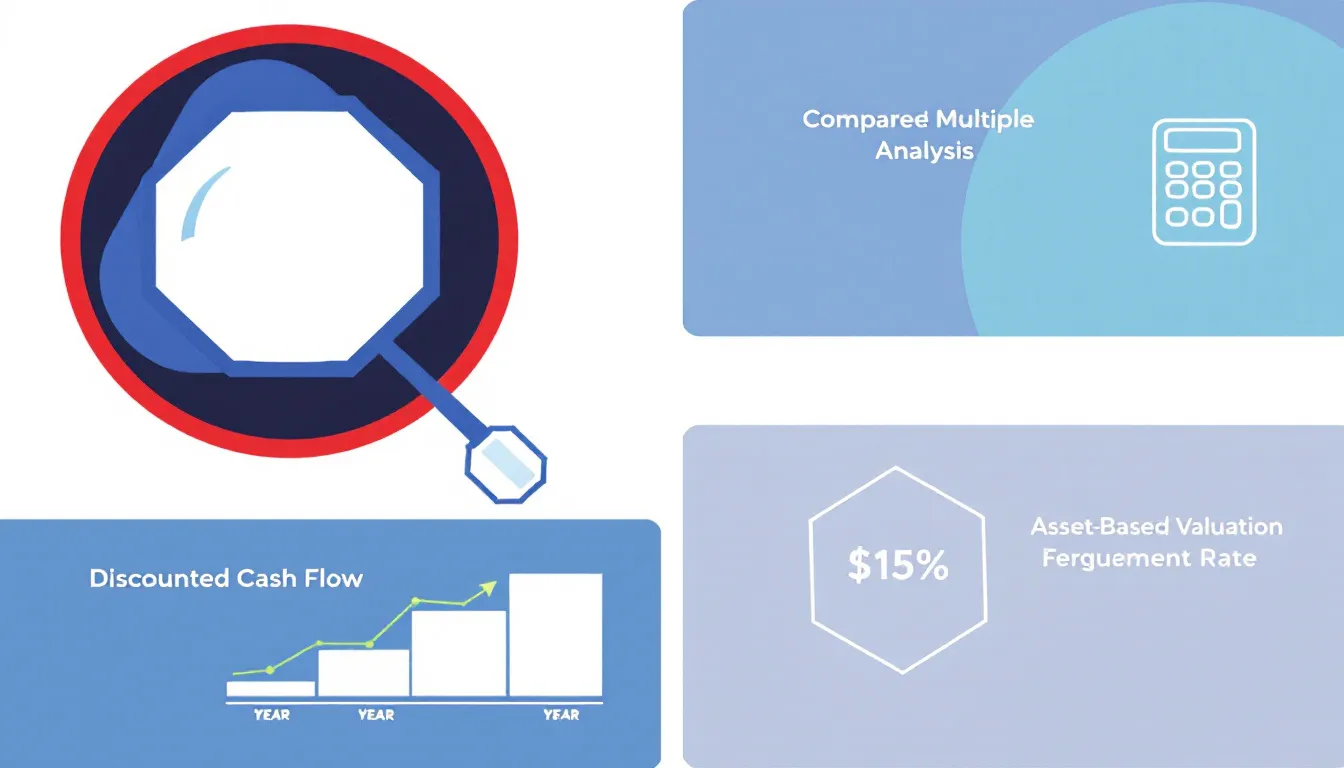

Common Valuation Methods for Shopify Stores

Three common valuation methods for Shopify stores include the Earnings Multiplier Method, Discounted Cash Flow Method, and Comparable Sales Method. Each valuation method offers a unique approach to estimating store value, helping stakeholders evaluate opportunities by projecting potential income. Each method works effectively in different contexts, such as the multiples method being advantageous for fast-growing companies or the SDE method leveraging recent sales data.

The calculator’s output is often based on Seller’s Discretionary Earnings (SDE) multiplied by an Adjusted Multiple. These methods offer a clearer picture of your store’s value and guide strategic decisions.

Earnings Multiplier Method

The Earnings Multiplier Method estimates store value based on a price-to-earnings ratio. This method utilizes different types of earnings such as EBIT, EBITDA, and net income to gauge the business’s value. Common earnings multiple for valuing businesses typically range from two to six times EBITDA and one to five times annual sales.

The level of risk in the Earnings Multiplier Method is determined by factors such as industry type, financial aspects, and market trends, with a lower risk example being using a $100,000 profit with a higher multiple of 3 to estimate a $300,000 value. The multiplier varies based on industry standards and market conditions, which means different sectors apply distinct multiples to earnings.

Discounted Cash Flow Method

The Discounted Cash Flow (DCF) method focuses on the projected cash flow of the company. This method considers the value of today’s money under tomorrow’s economic conditions. To calculate present value using the DCF method, you need projected cash flows and a discount rate. The anticipated rate of growth in business earnings is crucial as it helps estimate the percentage growth rate, ranging from 0% to 100%, which affects the projection of future cash flows.

For example, the estimated value of a business projected to have annual cash flows of $500,000 using a 10% discount rate is $1.9 million.

Comparable Sales Method

The Comparable Sales Method determines value by comparing similar companies that have recently sold. This method adjusts for factors such as location or size differences. For example, a retail store can be valued by comparing it to three similar stores. If those stores sold for an average price of 1.5 times their annual revenue, a store with an annual revenue of $2 million would be estimated to be worth $3 million.

Fast-growing companies or those planning to sell benefit most from market-based valuation.

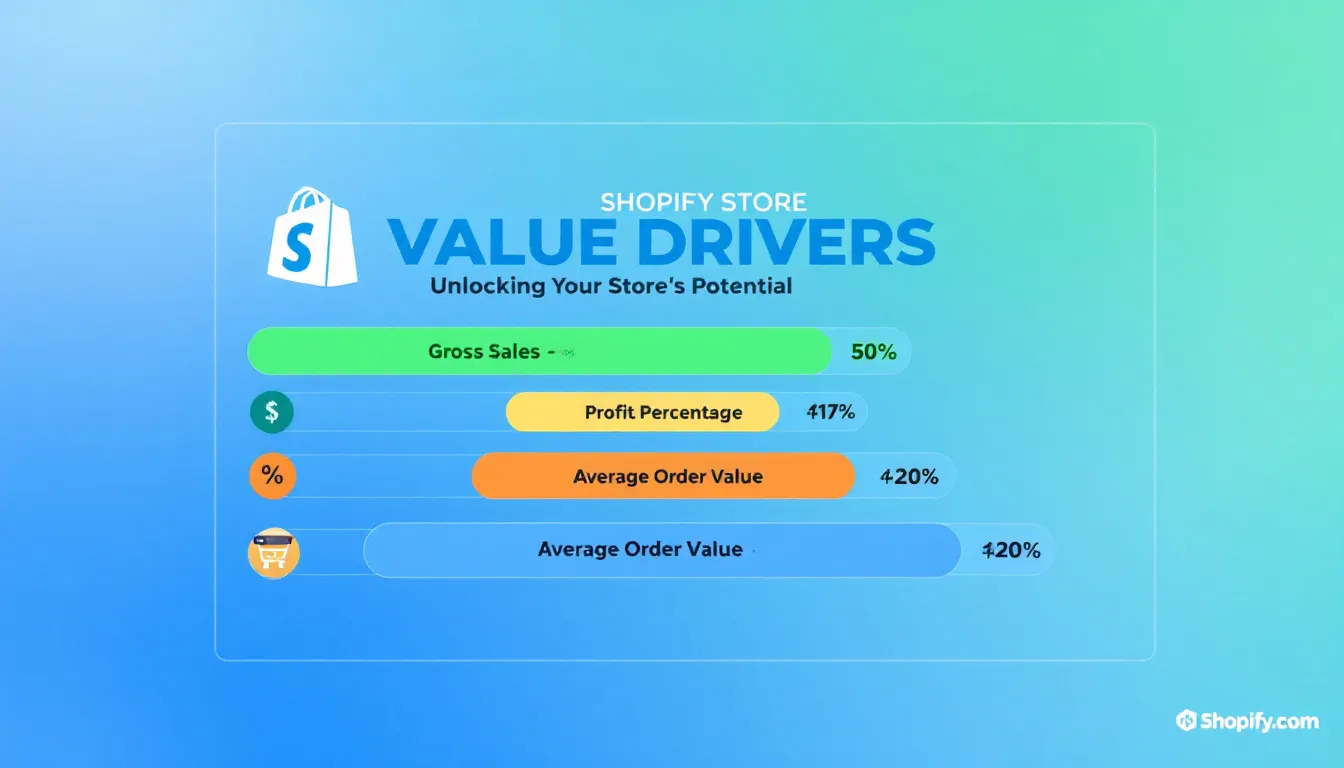

Factors Influencing Your Shopify Store’s Value

Several factors influence the value of a Shopify store. A clear valuation aids in identifying business trends and areas that can be improved. Understanding a business’s worth is crucial for making informed financial decisions, such as investments, sales, and securing loans. Shopify store valuations often incorporate factors specific to e-commerce, including customer acquisition costs and lifetime value. Enhancing the value of a Shopify store can be achieved by implementing targeted strategies tailored to its unique performance metrics.

Three main factors and other factors play a critical role: financial performance, customer base and engagement, and growth potential. Each of these elements significantly impacts the overall valuation.

Financial Performance

Consistent revenue and profit margins are critical for enhancing a Shopify store’s overall valuation and accurately assessing the company’s worth. Stable revenue streams and healthy profit margins provide a solid foundation for increasing market value.

Additionally, evaluating the company’s assets, including both tangible and intangible assets, is essential for understanding the store’s financial health and overall value. This comprehensive assessment provides potential investors with a clear picture, especially when considering the sale or closure of the business.

Understanding the calculation and significance of net income helps highlight the financial health of the store, impacting its valuation.

Customer Base and Engagement

A large and engaged customer base can significantly boost the perceived value of a Shopify store. High engagement rates and a loyal customer base enhance the overall value of an online store. Additionally, unique intellectual property can play a crucial role in enhancing store value by serving as a significant intangible asset that attracts investors and influences overall valuation.

A loyal customer base enhances revenue stability and reduces marketing costs, which positively impacts business valuation.

Growth Potential

Growth potential critically affects valuation. Businesses can achieve growth and profitability by increasing market share, introducing new products, merging or acquiring companies, and opening new locations. Larger businesses often have more complex growth strategies due to their multiple stakeholders and management layers.

The maximum number of years earnings that can be entered for expected continuing earnings is 10. This assumption significantly impacts the valuation, reflecting the business’s future performance.

Steps to Improve Your Shopify Store’s Value

Improving the value of your Shopify store involves implementing targeted strategies. Future growth projections significantly influence valuation, focusing on expanding market share and optimizing existing customer relationships. These strategies are particularly crucial for small business owners, many of whom may not be fully aware of their business’s value.

Three main steps can significantly enhance your store’s value: optimizing marketing strategies, improving customer experience, and diversifying product offerings.

Optimize Marketing Strategies

In the current digital landscape, businesses must establish a strong online presence. Effective search engine optimization (SEO) ensures a business’s valuation services are easily discoverable by potential clients. Utilizing high-tech tools can significantly enhance digital marketing strategies by providing advanced analytics and automation capabilities.

Content marketing helps businesses demonstrate authority in their field by providing valuable information that addresses client inquiries and challenges.

Improve Customer Experience

A seamless mobile experience is crucial, as many customers shop using their devices and expect quick load times. A seamless shopping experience fosters repeat purchases and customer loyalty.

Aligning a manager’s salary with industry standards can improve operational efficiency, ensuring that resources are allocated effectively. Integrating live chat support can help address customer inquiries in real-time, improving the likelihood of conversion.

Diversify Product Offerings

Offering complementary products through cross-selling can enhance the customer shopping experience. Expanding your product range is crucial for attracting a broader audience. Companies with significant physical assets, such as those in manufacturing or real estate, can leverage these assets to support product diversification. Expanding product offerings can significantly boost sales by providing more options to customers.

Valuation for Strategic Decision-Making

Business valuation is essential for strategic decision-making, as it provides insights into the business’s financial performance, growth potential, and market position. By understanding the business’s value, owners can make informed decisions about investments, expansions, and other strategic initiatives. Valuation can also help business owners identify areas for improvement and optimize their operations to increase the business’s worth. Additionally, valuation can facilitate communication with potential buyers, investors, or partners, as it provides a clear understanding of the business’s value and potential.

Why Knowing Your Shopify Store’s Value is Important

Knowing your Shopify store’s value is crucial for various business decisions, from planning to selling. Knowing your store’s worth helps you identify strengths and weaknesses in your operations. A business valuation can guide strategic planning and ensure informed decision-making. Business based valuation methods, which assess a business’s worth by analyzing its potential to generate future income or cash flow, are particularly relevant for understanding store value.

Working with valuation professionals ensures accurate business assessments and insights, adding another layer of confidence to your decisions. Whether you aim to attract potential buyers, secure funding, or plan for future growth, knowing your store’s value is a vital step in achieving these goals.

Attracting Potential Buyers

A clear and well-documented valuation can significantly expedite the sale process by establishing clear expectations for potential buyers. Market value and liquidation value determine your store’s actual worth, crucial during negotiations. Understanding your company’s worth can also aid in negotiations by providing a solid foundation for discussing price and terms.

Highlighting a store’s sellable tangible assets might uncover overlooked resources that can prove valuable in negotiations, attracting more serious buyers.

Securing Funding

Having a solid business valuation is crucial for securing funding. Investors often require a detailed business valuations to assess risk and potential returns before committing funds. A proper valuation can significantly increase the business value and the chances of attracting loans or investments for business growth. Understanding net assets is crucial in these financial assessments, as it represents the company’s value by calculating the difference between total assets and liabilities.

This financial insight reassures investors about your store’s future profitability.

Planning for Future Growth

Regularly evaluating your business’s worth helps in aligning growth strategies with financial goals. Prioritizing customer retention is more cost-effective than acquiring new customers, making it vital for long-term success.

Consulting with other business owners in your network can provide valuable insights and a second opinion, enhancing the accuracy of your strategic planning. Knowing your store’s value enables informed decisions that support sustainable growth, ensuring strategies are financially sound and aligned with your business objectives.

Summary

In summary, using the Ignite Viral Media calculator provides a quick and efficient way to understand your store’s worth. Accurate inputs such as annual revenue, net profit, and traffic metrics are essential for reliable valuations. Understanding your valuation results involves interpreting financial metrics and evaluating your market position. Additionally, understanding the value of your business is crucial for making informed strategic decisions.

By familiarizing yourself with common valuation methods and identifying factors that influence your store’s value, you can take actionable steps to enhance it. Knowing your store’s value is not only crucial for attracting buyers and securing funding but also for strategic planning and future growth. Embrace these insights and take your Shopify store to new heights.

Frequently Asked Questions

Why is it important to know my Shopify store’s value?

Understanding your Shopify store’s value is essential for making informed business decisions, attracting potential buyers, securing funding, and effectively planning for future growth. This knowledge empowers you to strategically navigate your business landscape.

What are the main inputs for the Shopify Store Value Calculator?

The main inputs for the Ignite Viral Media “Millionaire-Maker Strategy” are annual gross sales and profit percentage after expenses. Plus marketing multipliers including Google Ads ROAS, monthly SEO Traffic, SEO Traffic value, your Shopify “online store conversion rate” percentage, email list size, and email marketing revenue! Providing accurate figures for these elements will yield a more precise valuation of your store.

What is the Earnings Multiplier Method?

The Earnings Multiplier Method values a business by applying a price-to-earnings ratio, typically between two to six times EBITDA or one to five times annual sales. This approach provides a straightforward way to assess a store’s worth based on its earnings potential.

How can I improve my Shopify store’s value?

To enhance your Shopify store’s value, focus on optimizing your marketing strategies, enhancing customer experience, and diversifying your product offerings. These steps will not only attract more customers but also boost overall store performance.

How does customer engagement impact store valuation?

Customer engagement significantly boosts store valuation by enhancing revenue stability and reducing marketing costs, ultimately leading to a more favorable business assessment.